Office Hours: What’s New in Home Consumer Engagement

Industry, Strategy

| 27 Aug 2025

💡 Key takeaways:

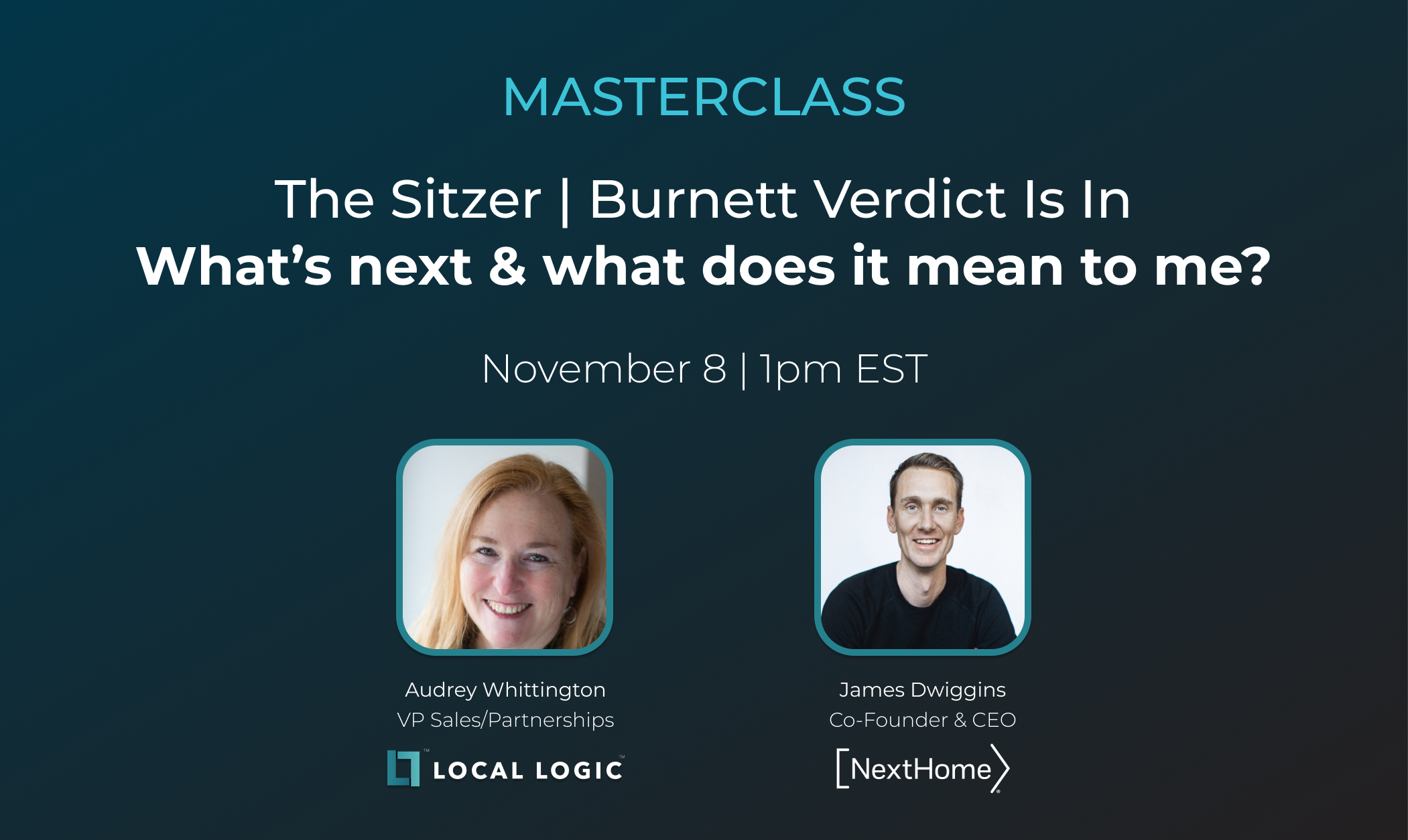

Watch our latest Masterclass on “The Sitzer | Burnett Verdict Is In — What’s next & what does it mean to me?”

The exchanges in this Masterclass are based on a considerable amount of research, the opinions of our panelists, and discussions with industry experts and lawyers who follow and/or are involved with these cases. For further guidance and professional advice, please consult your lawyers, insurance agents, or CPAs.

Since 2019, several lawsuits have been filed and granted class-action status. Sellers alleged that they were required to pay commissions for buyers’ agents. This long-standing practice aimed to ensure a smooth transaction and attract buyers to the table. However, the plaintiffs claimed collusion between the National Association of Realtors (NAR) and key industry players, alleging that these practices artificially inflated compensation.

This legal battle consisted of three key cases: Nosalek v. MLS PIN, Moehrl v. NAR, and Sitzer/Burnett v. NAR. The most recent case, Sitzer/Burnett v. NAR, concluded with a staggering verdict of $1.78 billion. The jury ruled in favor of the plaintiffs, with potential damages reaching around $5.3 billion due to antitrust claims. The verdict’s financial repercussions are significant, with several more potential lawsuits on the horizon.

As the industry awaits the judge’s ruling on the total damages, plaintiffs might seek injunctive relief. There are likely to be outright requests to ban the cooperative compensation rule in the MLS, making it impossible for listing agents and sellers to determine buyer-agent compensation in advance.

Defendants may also appeal as none of these companies can afford these kinds of damages. Defendants would have to post a bond and get somebody to guarantee damages since the judge does not want the defendants to spend all of their money before plaintiffs receive any compensation.

Plaintiffs have indicated a desire to settle. They have already done it with RE/MAX and Anywhere. Since the industry does not have $5.3 billion, it can either negotiate a settlement for what it can afford or file for bankruptcy. Plaintiffs would not receive anything if the Defendants declared bankruptcy, so that is not something they necessarily want.

Check out our previous masterclass on The Bombshell Lawsuits that Could Change the Real Estate Industry Forever for more details on the lawsuits’ implications for homebuyers, real estate professionals, and the National Association of Realtors (NAR).

The core of these lawsuits revolves around NAR’s Clear Cooperation Policy (CCP) and the requirement to offer compensation in the Multiple Listing Service (MLS). Plaintiffs argue that these rules contributed to propping up commissions in the real estate market. The legal intricacies of these cases raise essential questions about industry practices and regulations.

The real estate industry and agent behavior can be expected to undergo various changes and requirements, including the following:

There is ongoing debate about whether the DOJ wants to eliminate the CCP. The latter mandates that when a real estate agent lists a property, they must put it on the MLS to maximize exposure. This was implemented to prevent agents from privately selling to their own buyers and potentially reducing their commission. Statistically, listing on the general market yields a 15% higher price than off-market deals.

The DOJ is investigating this policy, but some argue that repealing it could harm sellers. Although there are implementation issues with CCP, it’s intended to protect consumers. The issue with the DOJ stems from the requirement to offer compensation to the buyer’s agent. If this requirement is removed, CCP could still be a beneficial rule for protecting sellers, even without the compensation aspect.

The practice of dual agency, where the same agent represents both the buyer and seller in a real estate transaction, is also currently a subject of debate. Many view dual agency as a problematic practice and not in the best interest of consumers. Dual agency is associated with a high number of errors and omissions claims in the real estate industry, making it a potential area of scrutiny for the DOJ. While there may be some limited cases where dual agency is appropriate, the consensus is that it is generally not advisable.

Models are intended to limit liability, provide clarity, be transparent, and help people understand what they are buying. There are essentially three existing models:

Hourly models may not be feasible if there is pressure on compensation on the buy side. Brokerages will not take on more expenses when their revenue pool is shrinking. In this case, the other two models might gain some traction.

For most Americans, buying a home is the largest transaction they will ever make. The real estate closing process is complex, involving extensive documentation and legalities. Buyer representation is vital in helping consumers navigate this process and mitigate risks. People get a clearer understanding of exactly what they’re buying — not just the house, but the nearby schools and laws in effect as well as other factors that affect its value.

In transactions where both buyers and sellers are represented, fewer legal issues arise later on because things have been clarified and understood up front. The chances of ending up in legal liability increase considerably when clients are unrepresented. This is not the end of buyer’s agency — consumers are still willing to pay for convenience and premium service. Rather, buyer agents will need to change the way they do things as people become more educated about their choices.

Potential changes in the industry may shift the responsibility of compensating the buyer’s agent from the seller to the buyer, with regulations and clear disclosures expected to provide transparency to consumers.

A buyer can instruct their agent to include in the purchase contract that the seller should pay the buyer agent’s compensation. The seller has the choice to agree to this arrangement or offer a credit to the buyer, who can then pay the agent. This can involve negotiating various terms, including the portion of the compensation paid by the buyer and seller. This practice is common in commercial real estate and can be customized in several ways.

The United States faces a housing shortage of 5 to 6 million units, contributing to rising home prices and overall wealth. Housing — encompassing financing, repairs, sale of property, and related services — plays a crucial role in the country’s economy as it accounts for approximately 20% of the Gross Domestic Product (GDP).

As a result of the Sitzer-Burnett verdict, the future landscape of the real estate industry will undergo significant changes — including a shift in the number of agents on the market and a need for more equity.

There will be fewer agents as some of them will leave the industry due to low earnings. The number has already been dwindling since 2008 when the industry had about 1.4 million realtors. By 2010-2011, that number was down to 1 million. The ongoing trend may continue, resulting in a further decline in the number of agents, if the industry fails to effectively communicate its value.

The industry needs to be more equitable and more careful about how it articulates its value. New models, including buyer’s agency, will be introduced. Some people may take advantage of those models, but they will still include compensation in one form or another.

In conclusion, the Sitzer-Burnett verdict has far-reaching implications for the real estate industry. While it has the potential to reshape the way real estate transactions are conducted, it also raises important questions about consumer protection and industry practices. As the future landscape of the real estate market evolves, industry professionals and consumers need to stay informed and adapt to these changes.

In case you missed it, don’t forget to check out our previous masterclass on The Bombshell Lawsuits that Could Change the Real Estate Industry Forever.