Office Hours: What’s New in Home Consumer Engagement

Industry, Strategy

| 27 Aug 2025

Summary

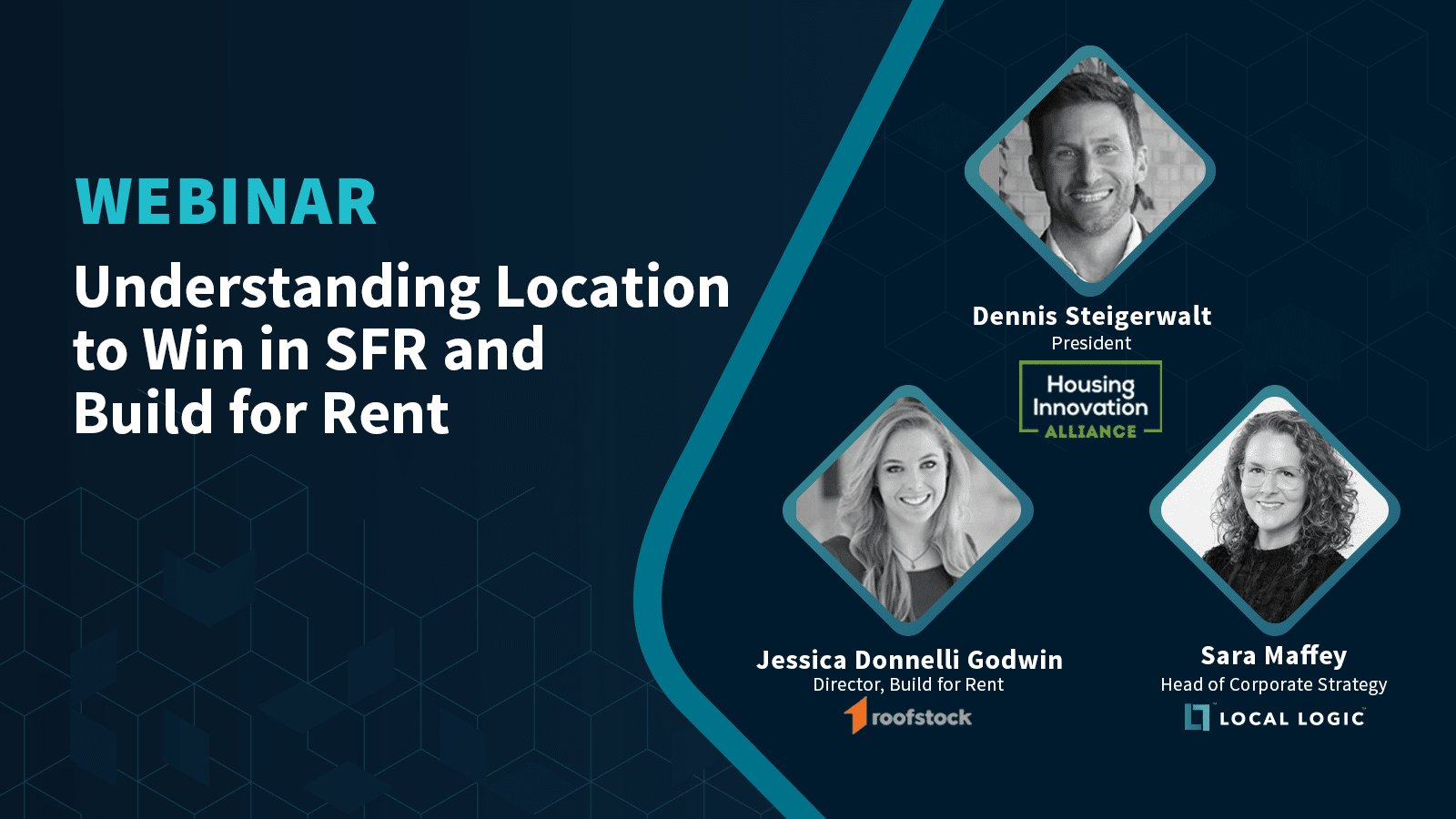

We recently invited our friends from the Housing Innovation Alliance and Roofstock for a masterclass on single-family rental & build for rent.

For over 30 minutes, Dennis Steigerwalt, President of the Housing Innovation Alliance, Jessica Donnelli Godwin, Director, Build for Rent at Roofstock, and Sara Maffey, Head of Corporate Strategy & Business Development at Local Logic, discussed:

Dennis Steigerwalt: Well, thank you very much. It’s a real pleasure to be here. And I want to say thank you to the entire Local Logic team for having me help co-host this event today. It’s an exciting topic for us. The Build for Rent Opportunity is something we’ve been following closely for the last decade. And as everyone knows, it’s really gained steam over the last, let’s say, three to four years.

And it’s been just about every newspaper article you read last year. So I think there’s a lot that we can uncover here, especially as we get into how we can use data to drive a better decision-making in both build for rent and single-family rental. So I’m going to be excited to talk to Sara Maffey from Local Logic on this topic, as well as Jessica Godwin from Roofstock. So before we get into that, just give you a quick overview of what my organization is all about.

So the Housing Innovation Alliance is an innovation-focused, forward-thinking group of about 200 companies from around the country that looks for how we can build better to create more attainable housing for middle-income households across the country. So we use the scale of the production home builder to do that. And as I mentioned, build for rent is a big part of the business model exploration that we do to help drive that attainability across the marketplace.

Sarah and Jessica, I’d love for you both to take the opportunity to introduce yourselves and your organizations to the audience here.

Sara Maffey: Yeah, thanks, Dennis. And I love that you have a whole like single-family built for a day ahead of you. This is great. So I’m Sara Maffey. I’m the Head of Corporate Strategy and Business Development at Local Logic. And before joining Local Logic, I worked in commercial real estate, and what Local Logic does is use data to quantify everything outside the four walls of the asset.

I can get a little bit more into that, you know, as we go. But basically, we are looking at different forms of transportation, schools, grocery stores, retail, and things that you might think of as being a little more subjective, like the character of the neighborhood, the vibrancy and we’re using data to quantify all of that. So that’s a little bit about us.

DS: Great. Thank you, Sarah. Jessica, please.

Jessica Donnelli Godwin: Yes, I am Jessica Donnelli Godwin. I am the director of Build to Rent at Roofstock. Your stock is a platform for all things single-family rentals, including Build to Rent. And we actually, similar to you, Sarah, but we’re on everything quantifiable around an asset. So underwriting single-family rentals and understanding everything around that space. And then I specifically focus on portfolio transactions of build to rent homes on the sell-side.

My background is in commercial real estate brokerage and I really look forward to this conversation today.

DS: This is great. So we have the two right people in the room to give us better access to the information we need to have, and the awareness we need to make better decisions. So this is great. And I think it’s an opportune time as well to have this discussion, based off of helping, you know, builders of all sizes and investors of all sizes navigate this market opportunity.

You know, Sarah, along those lines, can you share a little bit more about the types of insight, the solutions that Local Logic offers?

SM: So we were founded by urban planners, and I think that that kind of nerdiness really comes out in the types of insights we have available. And as I mentioned, we are quantifying all those things around the asset. We make our insights available as APIs. We have a platform. We’ve also got some great consumer-facing products. So really thinking about location in whatever flexible way works for you, whatever that data need is.

I think it’s really interesting because we’re basically allowing you to understand the value of location and really just input those insights directly into models. It’s great if you’re looking at a whole scattered, say, portfolio, for example, you can use our location scores to understand the nuances of each of those sites. And I think some of our natural language texts, our neighborhood profiles help investors understand the neighborhood that these sites are situated in.

So we really provide a whole kind of gamut of ways of understanding the value of location. And some of the things we’re working on just in terms of understanding how neighborhoods change over time, which is really important if you’re going to hold this for any variety of time, and we’re about to launch our wellness score, which I think we’ll get into a little bit later but I’m really excited about it. I think it’s a piece of the puzzle that we’ve been missing around talking about quality of life. So a lot of exciting stuff.

DS: OK, great. So I would just want to add to that, Jessica, you mentioned you were more at the asset level. Tell us a little bit more about your marketplace and the offerings that you’re providing at Roofstock.

JDG: Absolutely. So Roofstock is a very vertically integrated investment platform for single-family rentals. We have a property management company and we have a retail marketplace where anybody can go to roofstock.com and browse for really any residential investment property opportunity across the country. We can help match with a third-party property manager so that people can buy in an area where they don’t live, which has never really been possible before.

And we also have an investment services team that can help work with institutional investors to bulk up their portfolio and then manage for it as well. And then I work on the portfolio services team that still sells full scatter sites, and single-family rental portfolios as well as build to rent portfolios in dedicated communities or infill kind of scattered-site and build for rent.

DS: Excellent. So this again, perfect right and left glove here in these conversations, if we’re doing a data analysis to find out where we should be placing our time and investments. You know, we kind of jumped right into this and I want to dial it back a little bit and give share the opportunity to kind of tell how do you view single-family rental investment opportunities through the lens of Local Logic and you know, why is it so important in today’s market?

SM: So I think, you know, at a base level when we’re talking about SFR we’re talking about these single-family rentals and we’re not getting specific about what size investor we’re talking about here because I think, you know, institutional money has really come into the space. But the reality is, you know, it could be a mom-and-pop investor, it could be middle market. So we’re kind of all over the spectrum.

We have solutions that could really serve all of those different needs. But I think what’s really exciting about SFR for Local Logic is that we enable the ability to look at portfolios at scale. So when you’re talking about calling our API or location scores, for example, this is the ability to look at hundreds or thousands of sites, you know, with one API call and really understand all these different nuances of the area around that asset or those assets.

So it’s really, I think, a way for us to add a lot of value to this space. I think the other interesting thing around SFR today is that you have a lot of investors who are looking at markets that they’re not necessarily located in. And especially as you get to the institutional level, it’s not just folks who can drive an hour or 3 hours to go see these sites and really understand the nuances of that city or that market.

So I think that the ability to understand location at scale and using data instead of having to rely solely on your personal knowledge of a specific market is becoming more and more of a hot topic right now, and that’s what our insights allow you to do. So it’s not about replacing boots on the ground, it’s about augmenting boots on the ground in your current processes for us, and I just love the opportunity to just scale your ability to do that. I mean, if you’re just relying on going and visiting these properties as an individual or relying on your local team, this is a great way to just expand your capability and start opening up new markets.

DS: And one, there’s a lot of existing inventory out there too, right? So, you know, any way you can tie it better spend your time on the front end to assess where you want to be. And there are a lot of markets that have yet to be uncovered or explored, as you said, so that you can really kind of tap into the future potential of those markets as they evolve.

SM: I was just going to add one of the things you were saying about kind of moving quickly. I think that’s the other piece about using data, right? So if an opportunity comes to you, you don’t have to take the time to actually go drive around and understand what does this opportunity actually look like in reality.

If you can do that in 5 minutes, by just pulling the data into your existing model, then that speeds things up, especially in the market right now that we’re dealing with where you have to be able to transact super quickly.

DS: I was going to say, and this is a question for both of you, my wife’s a realtor, so I see what goes on on the buy-side for existing inventory. And I can hear secondhand a lot of the conversations and it’s heated and then imagine the competitiveness and from what we’ve heard across our network is very similar in both build for rent and single-family rental.

So by arming your teams or your clients with the data they need, they’re able to act faster and make more prudent decisions for their stakeholders. Right?

JDG: Absolutely, and to Sara’s point of kind of understanding markets, you can go to a market and you could drive around the neighborhood for an hour, but that still doesn’t always give you the exact picture of what it’s like to live in the area, what the amenities are like, and how people feel about living there.

So I think that any tool that you can use to help get to that really does help speed up the process and decrease uncertainty, which also kind of helps things move more quickly. And often we’re working with clients who don’t have to go, then present opportunities to investment committees. And so being able to tell that whole story of what is the opportunity here can be really helpful because we’re all limited on the amount of time that we have and how many markets we can actually get to see with boots on the ground and having data to support that is extremely helpful.

DS: I think that as you look at where a lot of these opportunities lie in the future, especially in the single-family rental side and even for build to Rent, which we’ll get into, it’s going to be on the fringe of existing or proven markets. So the data sets on the rents aren’t necessarily there that the investment committees are going to need. So you have to get creative in how you frame these conversations. And I think that the resources that one can access from both your platforms takes it from a fuzzy watercolor to a pencil sketch, if you will, when you’re pushing it in front of the investment community for a decision.

SM: Or a really nice heatmap in our case.

DS: Well, let’s switch gears a little bit. Jessica, we mentioned single-family rental, existing inventory. Let’s talk a little bit more about the build for rent category and new construction. So talk to us a bit about what you’re working on in that area through Roofstock.

JDG: Absolutely. So kind of an overview really built for rent is single-family rentals that are new construction. So, you know, they all today’s build for rent is tomorrow’s know, single-family rental market. So it really all blends together and it’s a lot of the same investors in the space that are just looking to scale. I think right now only about 2-3% of the single-family investment market is owned by institutions.

And currently, most of them are going around and still trying to buy one-off homes and there aren’t a whole lot of portfolios in the market. We do at Roofstock, scattered-site portfolios, we have a couple coming up that are even in the thousands of homes. But it can really be difficult to get your hands on inventory in this market.

So a lot of times groups are looking at build for rent as a way to really scale in new markets. And then also just kind of add to their existing inventory. And we’ve worked with builders who may have sold to retail but then they also might be adding to their capacity by adding build for rent as kind of another segment of their building.

DS: That’s interesting, talk to us a little bit about the type of builders you work with on those programs?

JDG: So I think every builder kind of is or should be looking at build for rent in some capacity. There’s so much money floating in the market. I always say that apparently, it’s easier to raise $1,000,000,000 than it is to build a hundred homes. So for any builder who has the capacity to build any number of homes, I think there’s a great opportunity right now.

We have conversations going with the largest public homebuilders but a lot of who are working with are local and regional builders and developers. And sometimes we’re working with developers who we can help them partner with builders or sometimes the builders are coming to us directly.

DS: I think there’s a lot of potential there because there’s some trepidation to making this transition in their business. So I think anybody that can step out there and leverage an existing platform to help them navigate as they move from the for sale to rent side of the business, it’s very, very, very helpful.

We’ve talked about a couple of things here. We talked about the need for speed in decision-making. We’ve talked about growing interest, about various markets popping up, and how we can create a strong business case around investing in those markets. So in your opinion, why is this conversation so hot right now?

JDG: I think that this was already something that was kind of in the works prior to the pandemic, people wanting to maybe move into homes but not necessarily buy homes. So looking for residential homes to rent. And that’s typically been mostly with kind of mom and pop investors.

And I think that when the pandemic hit, it really accelerated this kind of trend of how do I get myself a piece of land so that I can spread out, I can grow my own veggies, I can have my backyard chickens, without having to put down a huge down payment because this is probably being driven mostly by millennials and a lot of millennials are still strapped by student loans.

And now rising interest rates certainly aren’t helping. But why limit the ability to live in a home just to people who are able to buy one? A lot of young families might want to live in a home and have that stability and also access to great schools.

But people might not want to buy maybe they just relocated from another state and they’re not sure what neighborhood they want to live in yet. So the kind of single-family rental space and build for rent really opens up more inventory for people to be able to live in homes.

DS: The desirability of that lifestyle. And, you know, it’s only, like you said, only accelerated by what we see with the pandemic. Sarah, what are your thoughts? What makes this such a hot market opportunity right now?

SM: Yeah, I guess I was thinking about it from like the investor side of things where, you know, especially lately with inflation, I think it’s a great way to hedge that. I mean, you’re looking at just shorter lease periods where you can start to adjust rents with what’s happening in the overall market, which I think is really important.

And what we’ve seen is institutional investors really starting to expand their portfolios of SFR. And what’s cool about that is maybe you were already investing in multifamily, but you can use SFR as this sandbox, to kind of innovate around residential and like the experience, the lifestyle that you’re providing and some of the economies of scale that you can get.

I think that just where we are today in the economy is really interesting for SFR. In terms of using data for that, the market is so hot right now – I like the kind of summary that you gave of like speed and scale, but we’re going to sort of move along in the cycle. And I think then there’s going to be even more opportunity to be more intentional, smarter, and using more data to make decisions.

So I think this is just something that’s going to continue to grow.

DS: As I look at, going back to Jessica’s point about creating more accessibility to certain locations and increasing the inventory at certain price points, I think that there’s certainly a demand for that and a need to get people in the door in neighborhoods they want to get into as quickly as possible.

I want to switch gears a little bit and focus on another acronym we’re hearing a lot in the industry. You know, we go from BFR and SFR to ESG. And, I think that, again, both are needed on the product side. And then if we look at the principles in which we deliver the product on the ESG side, I think this is something that we need to continue to focus on and I think businesses that have been doing this for decades are finally getting rewarded for it.

But one thing I’ve been looking at locally here in the Western PA market is how housing units that have been developed with strong energy performance standards and developed by companies that have strong ties to the fabric of the communities that they’re developing in, they seem to not only sell at a premium or rent at a premium day one, but as they’re re-renting, they’re outperforming market trends.

So the kind of the correlation I like to draw there, going back to that innovation sandbox concept is investors are going to hold these assets for 20, 25, 30 years in some cases, especially in the Build for Rent side, you have some institutional capital coming in and saying we’re running long term performance.

This allows you to invest a lot more upfront in the types of materials and the methodology, the technologies that allow you to better understand the operational expenses associated with it. So a long-winded way of getting to a question, but I’m seeing these observations take place in you’re just in western Pennsylvania and across some of our networks, I’m curious from your perspective, what are you seeing? Where does the opportunity lie for this market segment to take advantage of ESG principles, but then also incorporate some of that into your data platform.

SM: Well, ESG is something Local Logic thinks a lot about. And we’re really thinking about it not from the energy efficiency of the home itself because we’re really focused on everything outside those four walls. But I think that especially as you have institutional investment coming into this world, that ESG reporting aspect is also going to start to enter into this.

So just like they’d have to report on everything else in their portfolio, they’re going to have to certain reporting on these homes as well. And we really understand, you know, a lot of aspects of location that are integral to these kinds of considerations. We have climate risk data, which I think is on many people’s minds right now, especially, you know, depending on where you are in the country, whether it’s flood or storm or fire.

And we’re also approaching it from, you know, access to rapid transit, which is going to lower your personal emissions as a resident or your ability to access and walk to your day to day needs are on the site again, lowering your personal emissions, which is all part of that of that E. And I think for the S part, you know, the social aspects of ESG, we’re looking at livability, we’re looking at quality of life. We’re looking at affordable housing, and access to grocery stores, access to schools, those amenities that really impact our equal experience of places and the quality of life that you can have there.

DS: So again, taking that urban planning perspective and really trying to incorporate that into the scoring system, that’s great. Jessica, anything you’d like to add here on the ESG thought?

JDG: Absolutely. I think that as especially institutional investors are looking to get more responsible for their investment money and what they’re doing, you know, kind of in the world, I think ESG is a great way to shine in this space and build for rent really allows them an opportunity to get into that with real scale because they actually have more control over what’s going into those homes where they’re being built rather than just being kind of purchasing whatever is existing scattered-site.

They can really be intentional about what their investment dollars are doing. And I think it’s an amazing opportunity and being able to measure it will also be critical to being able to report back to shareholders or whomever and kind of show how responsible of an owner they are.

SM: And I’m just wondering, they’re like, you know, we were kind of talking about it from the investor side but I would imagine even just with the SFR, just because you were talking about really being targeted towards millennials, like I think it’s also being consumer-driven as well that folks want to understand the climate risk of where they’re going to live or what they’re purchasing, and they want to understand their own personal impacts on ESG considerations. So that’s also probably part of what’s driving this.

JDG: I completely agree. And it could really drive up rents knowing that you’re in kind of a more sustainable building, more and more energy-efficient, you’re going to save costs elsewhere. So you might be more willing to pay more in rent.

DS: And I certainly believe that there’s heightened awareness around all these topics and the benefits of the kind of investing in the right built environments from both a rental and an ownership perspective.

You know, along these lines, I saw a couple of hints on how this concept and others could be integrated into your platforms over time. So I’d like to get a little bit of information about your product roadmaps and kind of where you’re heading as an organization, we’ll start first with Local Logic, and then I’d love to hear where Roofstock’s plans are.

SM: Sure. So right now, you know, we have these 17 scores, we have demographic information, we’ve got all of this data that really gives a snapshot of everything around the asset. And what’s really cool that’s coming up on our roadmap is being able to expose the historic trends and the rate of change in these neighborhoods across these different characteristics.

So I think that speaks volumes, especially if you’re going to hold something for a long period of time: what is your potential ROI on this? What are you in for in the long term with how this neighborhood’s going to change as you hold these assets? And so that’s all part of it. And I think the next piece is really focusing on ESG, automating some of these insights to be able to just fit right into performance and into reporting and augmenting that so that it’s just easier to do.

I think that can be quite a quite an endeavor, especially as these firms are just starting to approach ESG. And the most, I guess, near-term thing on the roadmap is our new wellness or so we’re going to be launching that. I think it’s in two weeks, which is really exciting. And so we’ll have 18 scores and it will speak to, you know, healthy behaviors, fitness, healthy foods around the site at neighborhood and city level.

So that’s really exciting, and it’s coming very soon.

DS: That’s fantastic. Jessica, what’s in store for Roofstock?

JDG: I think it’s continuing to build upon our kind of data and tech platform and helping investors continue to make decisions and understanding like kind of implications of certain characteristics on rental rates and pricing and kind of taking it to the next level as well as integrating different pieces of the build to rent lifetime pipeline into our marketplace in some way.

So how do we work with landowners or lot owners and then different builders and how do we kind of help piece them all together in order to ultimately have able to rent home built?

DS: OK, great. Now I know, I know. Sara, we have this half-hour has just flown by, so we’re right up against the clock. If we have a little bit more time. I know there are a few questions that were posed by audience members prior to the discussion.

SM: I think we should definitely call out. We had some interesting, interesting questions come up on LinkedIn. So yeah, let’s, let’s go through this.

DS: No, this is great. All right. So I’ll start with our first one then. So location and established communities have always been a top reason for SFR success for owners and renters alike. From your research, are you seeing build for rent create new communities that grow from the necessity of rentals in areas that lack SFR inventory?

JDG: I think that we’re seeing built for rent communities pop up anywhere that there’s available entitled land or lots. We’ve seen a lot of infill and I think it’s a matter of kind of there are available lots there with the infrastructure necessary to build a home because build to rent is a fairly new, new thing.

So we haven’t had a whole lot of players historically coming in with the intention of buying land and then developing it out. That’s happening more and more now. But I think it was just kind of a function of available lots and entitled land, but I think that we will see that location intentionality continue to grow. And then also you know, along the lines of I used to be in retail, commercial real estate, and the retail follows the rooftops and so it’s kind of a chicken and egg thing as far as what are the amenities of an area and when will they get there after the homes are built. So it’s kind of well, we’ll just have to see how these communities start to evolve. But I, I know that there’s exceeding demand for what supply is available on the rental side.

SM: Yeah. And we’ve talked about this a little bit like when you’re doing these masterplan communities and suddenly just adding in the flexibility of not only will some of the homes be for sale, but also for rent, and then adding in potentially some amenities that, you know, you’re going to have to have almost like sort of a more spatially spread out multifamily like mixed-use development.

You know, like maybe you need to include access to a grocery store or certain other amenities out there as we talked about, kind of building further outside the ring of certain markets.

DS: I think that’s a great point. And I think there’s certainly this availability of lots and kind of permit ready if you will, is something that has been driving this today. But I think as you look forward, there’s a lot of opportunity to target for this purpose-built destination focus kind of initiatives that allow you to be an extension of an existing amenity base or create the amenity basis needed for more expansion.

We have one other question that came in via LinkedIn. I’ll throw this one out as well. So I’m curious if there is an algorithm active or in the works to determine how close to jobs, food, schools, health care, gas, childcare, et cetera, is reasonable for build to rent – appears investors are dropping them in the middle of nowhere in various cities.

I’m all for so-called affordable housing, but when you put them in the middle of a cornfield, 30 minutes to an hour from civilization, the word affordable becomes obsolete beyond the home purchase and monthly payment. Just curious to get your thoughts.

SM: Well, I guess that ties right in with what we were just talking about. And obviously, Local Logic is particularly adept at being able to help with all of those things. And I will add, like that question was actually on your post, Dennis. So this was not a plug for me, but when I read that, I was like, oh, wow, that’s exactly what we can provide. And I think, you know, whether you’ve seen what’s what is there, what amenities, what child care what you know, health care is right around the site today.

Or viewing it as a void analysis and understanding, you know, if you are going to build this purpose-built community or destination, what do you need to have there to really create the lifestyle that ultimately is going to allow people to actually live there and have that kind of day to day that they need to have.

JDG: Sara we might have to collaborate on what an algorithm could look like and then we’ll have to sell it to retailers or at least give it to them so they can know where they need to go next.

SM: Perfect.

DS: I know we’re right up against the clock now. How about so this has been a great conversation. I know there’s a lot more that someone can get into with both of your companies and both of you. What what’s the best way to follow up?

SM: For Local Logic, our website is locallogic.co and we’re going to be at IMN’s SFR East next week in Miami, and Jessica is as well. So, you know, come hang out with us and I think we’ll both have booths and it would be great to actually see people or just send us a note via the website.

DS: OK, great. Jessica, anything you want to add for those want to check them.

JDG: We will also be at SFR East. Also feel free to reach out through LinkedIn or Roofstock.com. Happy to chat built to rent any time. It’s a love of mine. So always available.

DS: Well, this has been a fantastic conversation, really. Appreciate the opportunity again to be a part of facilitating the discussion and excited to see how it continues with the algorithm that’s going to be developed here and some of these new tools that are coming out on the roadmap so thanks again, Sarah. Thank you, Jessica. Appreciate it.